祝贺乔赟同学顺利通过博士论文答辩 | DBA捷报

发布时间:2024-03-25 17:41

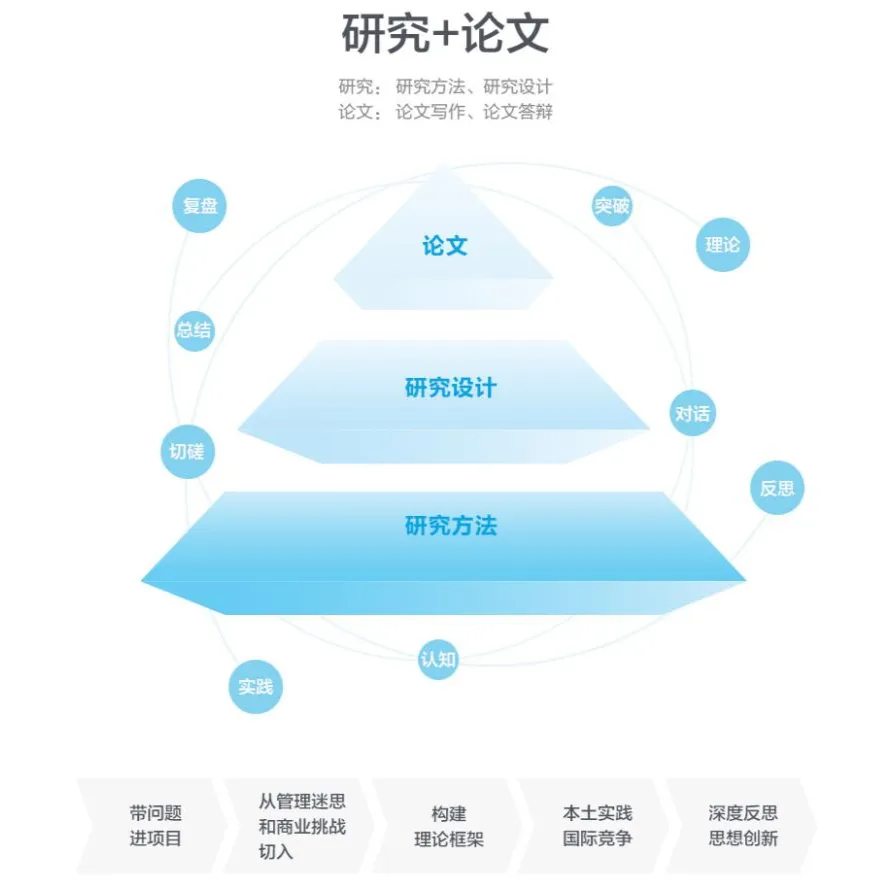

企业家学者项目(DBA)整合全球优质教育资源,打造极具前沿性和系统性课程,在框架模块、聚焦模块、专题研究+实践课堂这三大核心课程中,涵盖2大金融主题与4大微观主题,探索6大宏观方向,定制化行业专题,走访行业内领军企业。乔赟同学在理论与实践的交融中,锤炼出了应对新商业文明下层出不穷的新问题与新挑战的能力。他通过“理解—判断—实践—引领”的DBA学习路径,在企业家学者项目中不断接受新商业文明的洗礼与历练,从而实现了思想的跨越式“突围”。

本次论文答辩,来自长江商学院和新加坡管理大学(SMU)的教授们共同见证了乔赟同学的学术成果。

Man ZHANG

Associate Professor of StrategicManagement, SMU

Zhigang TAO

Professor of Strategy and Economics, CKGSB

Lin MA

Assistant Professor of Economics, SMU

乔赟 | 探索企业剥离:剥离的原因及方式

乔赟同学答辩中

▇ 论文摘要:

本论文包括三项关于企业剥离的研究。第一项研究探讨近年来广受欢迎的剥离重组方式——分拆。该研究旨在探索企业分拆的决定因素,并揭示该战略决策背后的动机。本文使用一组多维度的 2000 年至 2022 年期间美国上市公司分拆的企业数据集,并使用probit回归模型,验证了绩效假设、不完整契约假设、管理效率假设、财务约束假设和监管要求假设等五个假设。该研究对影响分拆决策的因素进行更系统的分析,为现有的企业分拆文献做出了贡献。

第二项研究,我们使用三个中国企业(国有企业,私有企业,及高科技上市公司)案例对中国企业剥离动机进行了初步的探索。

第三项研究探讨剥离工具,如分拆、股权剥离和出售。此研究分析公司的上市状态及企业性质是否国有是如何影响企业剥离方式的选择。该研究收集了在1992年至2022年间进行了战略性的剥离重组的 53,629 家亚洲公司的数据(包括16,225 家中国公司)。研究结果发现,上市公司及非上市私有控股公司出售剥离的概率更低;非上市公司,特别是非上市国有企业更倾向于采用股权剥离而不是分拆作为剥离方式;上市公司及非上市私有企业在剥离后使管理层持股的概率更高。然而在上市公司分样本的测试中,我们发现母公司股东集中度对管理层是否持有股份没有显著影响,基金所有权对管理层是否持有股份有显著影响。

答辩现场

▇ ABSTRACT:

This paper includes three studies on divestitures. The first study explores the popular divestiture tool of spin-off in recent years. The study aims to investigate the determining

factors of corporate spin-offs and reveal the motives behind this strategic decision. This

paper uses a multidimensional dataset of US-listed companies that have spun off between 2000 and 2022 and employs a probit regression model to examine five hypotheses: performance, incomplete contract, managerial efficiency, financial constraint, and regulatory requirement. This study provides a more systematic analysis of the factors influencing spin-off decisions and contributes to existing literature on corporate spin-offs.

The second study conducts a preliminary exploration of the motives for divestitures in Chinese companies using three case studies of Chinese enterprises (a state-owned company, a private company, and a listed high-tech company).

乔赟同学在长江DBA课程中

The third study explores divestiture tools such as spin-off, equity carve-out, and sell-off.

This study analyzes how a company's listing status and whether the enterprise is stateowned affect the choice of divestiture tools. The study collected data from 53,629 Asian companies (including 16,225 Chinese companies) that underwent strategic divestitures between 1992 and 2022. The study found that listed companies and privately held nonlisted companies are less likely to sell off divested units. Non-listed companies, especially non-listed state-owned enterprises, are more likely to use equity carve-out rather than spinoff as divestiture tools. Listed companies and privately held non-listed companies are more likely to allow management to hold shares after divestiture. In the sub-sample test of listed companies, we found that the shareholder concentration in the parent company has no significant impact on whether the management holds shares after divestitures. We found that the percentage of fund ownership has a significant impact on whether the management holds shares.

合影

论文答辩的圆满结束,对乔赟同学而言并非终点,而是他作为终身学习者崭新征程的起点。未来,他将携带着对中西方管理学理论的深刻认知与独特思考,持续践行新商业文明的理念,以独到的洞见,不断为中国经济注入新的活力,引领行业迈向更加广阔的发展前景。