祝贺蔡颖同学顺利通过博士论文答辩 | DBA捷报

发布时间:2023-12-13 16:50

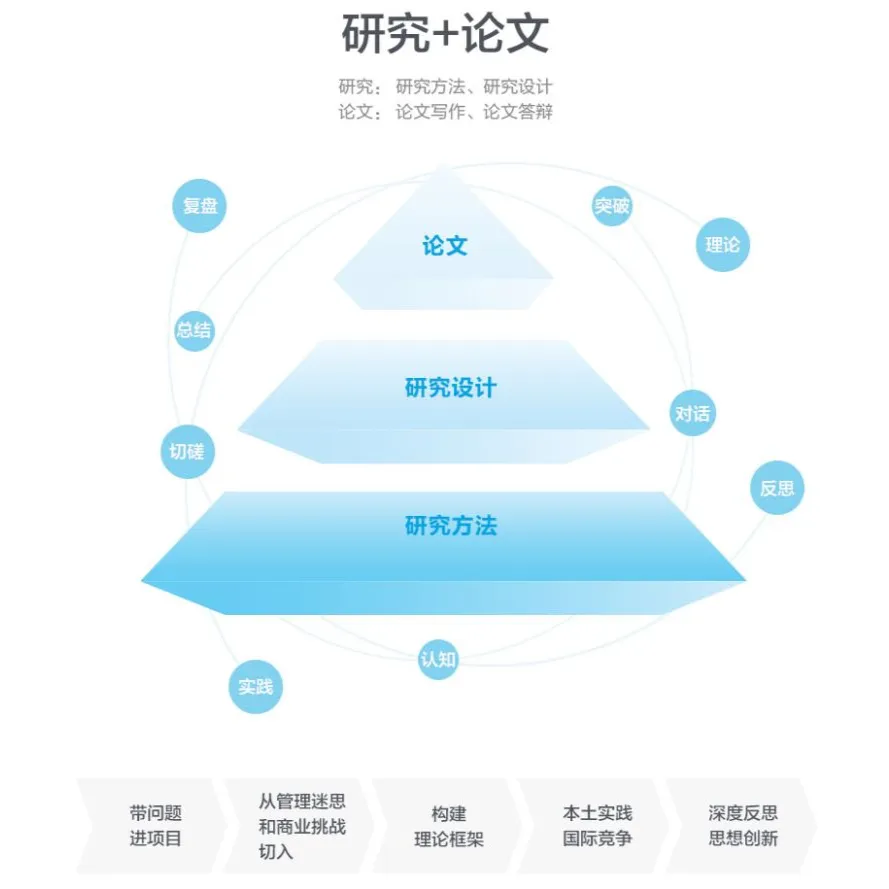

企业家学者项目(DBA)整合全球优质教育资源,打造极具前沿性和系统性课程,在框架模块、聚焦模块、专题研究+实践课堂这三大核心课程中,涵盖2大金融主题与4大微观主题,探索6大宏观方向,定制化行业专题,走访行业内领军企业。蔡颖同学正是在理论与实践的碰撞中,收获了应对新商业文明下新问题与新挑战的能力。“理解 - 判断 - 实践 - 引领”的DBA学习之旅,让她在企业家学者项目中历经了新商业文明的一次次洗礼,完成了跨越式的思想“突围”。

本次论文答辩,来自长江商学院和新加坡管理大学(SMU)的教授们共同见证了蔡颖同学的学术成果。

Jun TU

Associate Professor of Finance,SMU

Chunyan HUANG

Professor of Finance,CKGSB

Jing LI

Assistant Professor of Economics,SMU

蔡颖 | REITS行业特性与项目绩效的关系研究:宏观经济波动的调节作用

蔡颖同学答辩中

▇ 论文摘要:

作为一种特殊的投资工具,公募REITs项目使基础设施项目得以上市。本研究从公募REITs项目底层资产的行业属性入手,讨论了REITs项目绩效的决定逻辑,并进一步阐述了宏观经济冲击对这一决定逻辑的影响。基于中国REITs项目数据的研究表明:

第一,根据项目类型和行业特征,公募REITs的底层资产可以区分为成长性和安全性。其中,成长性是指投资标的具有发展潜力,表现为高风险、高收益;安全性是指投资于稳定且可靠的资产,且这些资产通常具有国家政策支持和政府补贴。成长性REITs与安全性REITs的投资回报具有显著的差异性。具体表现为,与安全性REITs相比,成长性REITs净利润、每股收益水平更高,同时涨跌幅也更大。

第二,在考虑宏观经济波动的情境下,成长性REITs在高股市波动和高通货膨胀率下表现更优,具有更高的总市值和换手率;安全性REITs抗抵御经济波动的能力较强,抗跌属性强于成长性,在利率较高的情况下具有更高的投资回报率和增长潜力。

第三,REITs与股票和债券等传统资产类别的相关性较低,其发展为投资者优化投资组合以降低风险提供了可能性,特别在经济波动时期,REITs的出现让普通投资者有机会参与房地产投资,并获得分红收益和股息收入。同时,不同行业特征的REITs抗风险能力也存在差异,投资者必须定期和更频繁地调整和重新平衡其投资组合。

本研究表明,REITs的发展为投资者优化投资组合以降低风险提供了可能性。投资者和决策者应重视REITs的行业特征,在REITs发展尚未进入成熟期之前,还需要从底层资产对REITs属性进行分析与判断,进而为投资提供依据。此外,投资者还需要考虑宏观经济因素的影响,并根据宏观经济变化调整其REITs仓位,以保证投资组合的收益。

答辩现场

▇ ABSTRACT:

As a unique investment tool, public REITs projects allow infrastructure projects to go public. This research starts from the industry attributes of the underlying assets of public REITs projects, discussing the determining logic of REITs project performance and further elaborating on the impact of macroeconomic shocks on this decision logic. Research based on China's REITs project data indicates:

Firstly, based on project type and industry characteristics, the underlying assets of public REITs can be differentiated into growth and safety. Growth refers to investments with development potential, characterized by high risk and high returns. Safety pertains to investments in stable and reliable assets, typically receiving national policy support and government subsidies. The investment returns of growth-oriented REITs and safety-oriented REITs are significantly different. Specifically, compared to safety-oriented REITs, growth-oriented REITs have higher net profits and earnings per share, with greater volatility.

蔡颖同学在长江DBA课堂上

Secondly, considering macroeconomic fluctuations, growth-oriented REITs perform better under high stock market volatility and high inflation rates, having a higher total market value and turnover rate. Safety-oriented REITs have a stronger ability to resist economic fluctuations, and their anti-fall attributes are more robust than those of growth-oriented ones, offering higher investment returns and growth potential when interest rates are high.

Thirdly, REITs correlate less with traditional asset categories such as stocks and bonds. Their development allows investors to optimize their portfolios to reduce risk. Especially during economic fluctuations, the emergence of REITs allows ordinary investors to participate in real estate investments and obtain dividend income and earnings. At the same time, REITs with different industry characteristics also vary in their ability to resist risks. Investors must adjust and rebalance their portfolios more regularly and frequently.

This study demonstrates that the development of REITs allows investors to optimize their portfolios to reduce risk. Investors and decision-makers should pay attention to the industry characteristics of REITs. Before the development of REITs reaches maturity, it is essential to analyze and judge REITs attributes from their underlying assets, thus providing a basis for investment. In addition, investors also need to consider the impact of macroeconomic factors and adjust their REITs positions according to macroeconomic changes to ensure portfolio returns.

合影

论文答辩圆满结束,但作为终身学习者,这是蔡颖同学的又一个起点。未来,她将带着对中西方管理学理论的认知与思考,继续践行新商业文明;用独到的洞见不断为中国经济注入新动力,引领行业的发展方向。