祝贺谭文清同学顺利通过博士论文答辩 | DBA捷报

发布时间:2023-02-23 17:37

日积月累作船桨,逐浪扬帆渡长江。经过在DBA的课程学习与实践,2023年2月23日,DBA四期班同学、以诺教育董事长谭文清迎来了他的最终答辩时刻。谭文清同学在答辩现场阐述了《针对ESG评级效应在中国A股市场的实证研究:关于中证800》,成果丰硕,最终顺利通过答辩。恭喜谭文清同学,让我们一起回顾他的高光时刻。

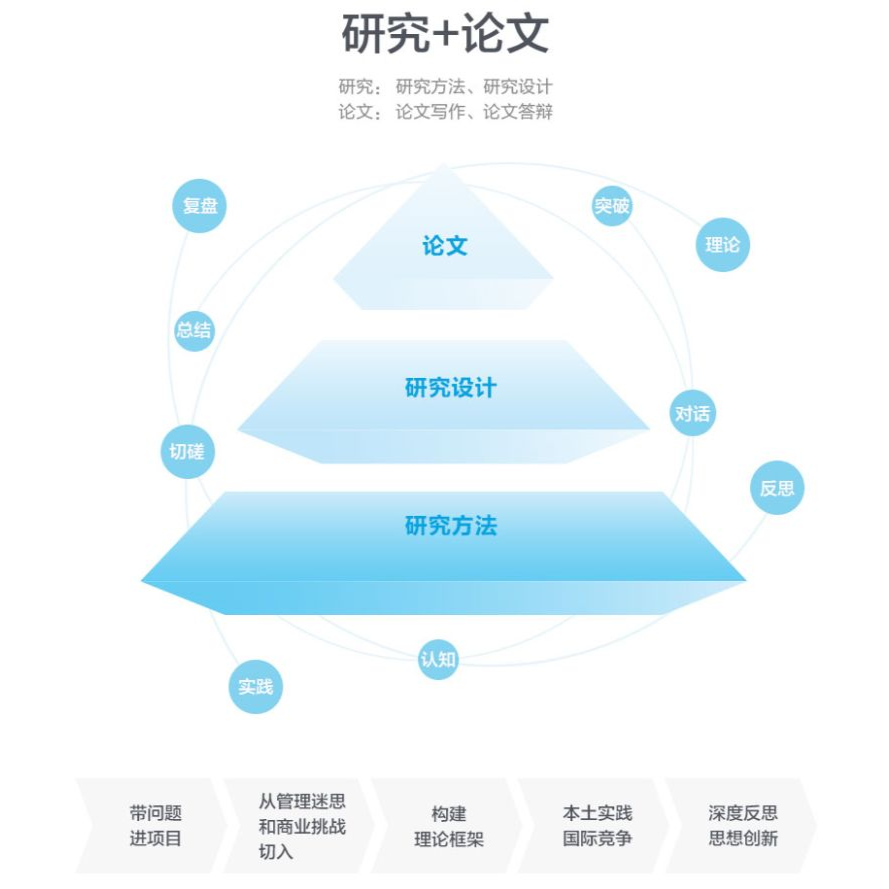

企业家学者项目(DBA)整合全球优质教育资源,打造极具前沿性和系统性课程,在框架模块、聚焦模块、专题研究+实践课堂这三大核心课程中,涵盖2大金融主题与4大微观主题,探索6大宏观方向,定制化行业专题,走访行业内领军企业。谭文清同学正是在理论与实践的碰撞中,收获了应对新商业文明下新问题与新挑战的能力。“理解 - 判断 - 实践 - 引领”的DBA学习之旅,让他在企业家学者项目中历经了新商业文明的一次次洗礼,完成了跨越式的思想“突围”。

本次论文答辩,来自长江商学院和新加坡管理大学(SMU)的教授们共同见证了谭文清同学的学术成果。

Fangjian FU

Associate Professor of Finance,SMU

Jie GAN

Professor of Finance,CKGSB

Heng YUE

Associate Professor of Accounting,SMU

谭文清 | 针对ESG评级效应在中国A股市场的实证研究:关于中证800

谭文清同学答辩中

▇ 论文摘要:

在后冠状病毒的VUCA时代与碳中和的计划背景下,ESG投资不断受到各界的关注。在政策层面,国家更加重视ESG实践与投资,成为经济发展的指导方针之一;在企业层面,ESG的概念鼓励企业在财务盈利能力之外更多地关注自身对环境和社会的影响,倡导可持续、绿色的经营模式。对于投资者而言,大量证据表明ESG方法有助于投资者规避单体或行业黑天鹅事件。当下中国A股市场所体现的巨大发展潜力,吸引了众多国际投资者的注意。然而与不断提升的市场影响力相对比,目前针对中国市场的ESG实证研究相对较少。

本文基于中证、万得等数据源,通过对中证800成分股、中证十大行业和全部历史样本的描述性统计,分析了样本的基本特征。针对ESG因素进行了分组检验(即中证800成分股和不同行业内)以及基于Fama-French五因子模型对ESG组合进行回归分析,本文发现G因子在分组回测中有着相对最好的表现,且有着不能被传统五因子所解释的额外信息。在此基础上,本研究试图构建一个中证800 Smart Beta指数增强策略。

研究结论表明,与基准(中证800)相比,通过等权及市值加权方式所构建的G+多空组合(高减低)可以明显降低年化波动率及最大回撤;从年化收益率来看,G+市值加权投资组合有着相对较好的表现,但缺乏一定稳定性。因此即使ESG组合还不能相对稳定地增强收益率,但并不会增加投资组合的成本,并且可以在一定程度上降低风险。

答辩现场

▇ ABSTRACT:

In the era of post-covid and VUCA, supported by carbon-neutral plans, ESG investment has attracted increasing attention. At the policy level, China has attached more importance to ESG practice and investment, which has become one of the guidelines for economic development. At the enterprise level, the concept of ESG, which encourages companies to further consider their impact on the environment and society in addition to financial profitability, continuously advocates sustainable and green business models. For investors, there is plenty of evidence that ESG approaches could help investors avoid individual or black swan events in the industry. Nowadays, China A-share’s considerable development potential has entered the horizons of more and more international investors. However, unaligned with the growing impact of the market, there are relatively few empirical ESG studies for the Chinese market.

谭文清同学在长江DBA课堂上

Based on data sources from China Securities Index and Wind, this paper mainly analyzes the basic characteristics of the samples through descriptive statistics of CSI 800 constituent stocks, the CSI top ten industries, and all historical samples. Based on the grouping back-test of ESG factors and the regression analysis of ESG portfolios based on the Fama-French five-factor model, it finds that the G factor has the relatively best performance and has additional information that the classical five factors cannot explain. On this basis, this study attempts to construct a CSI800 Smart Beta index enhancement strategy. Empirical results showed that the G+ long-short portfolio (high minus low) built by utilizing equal weighting and market capitalization weighting could significantly reduce the annualized volatility and maximum drawdown rate compared with the benchmark (CSI800). From the perspective of annualized return rate, G+ market-cap-weighted portfolio has relatively good performance but lacks specific stability. Therefore, even if an ESG portfolio cannot steadily increase the corresponding return rate, it will not increase the cost of the portfolio and can reduce the risks to a certain extent.

合影

论文答辩圆满结束,但作为终身学习者,这是谭文清同学的又一个起点。未来,他将带着对中西方管理学理论的认知与思考,继续践行新商业文明;用独到的洞见不断为中国经济注入新动力,引领行业的发展方向。