祝贺张建新同学顺利通过博士论文答辩 | DBA捷报

发布时间:2021-10-09 12:15

纸上得来终觉浅,绝知此事要躬行。2021年10月9日,DBA首二班同学、中商外贸有限公司董事长兼总裁张建新顺利通过论文答辩。张建新同学在现场进行了《构建对食品产业互联网企业进行业绩预判和价值评估的第四张报表方法研究》的主题答辩,最终顺利通过答辩。恭喜张建新同学!

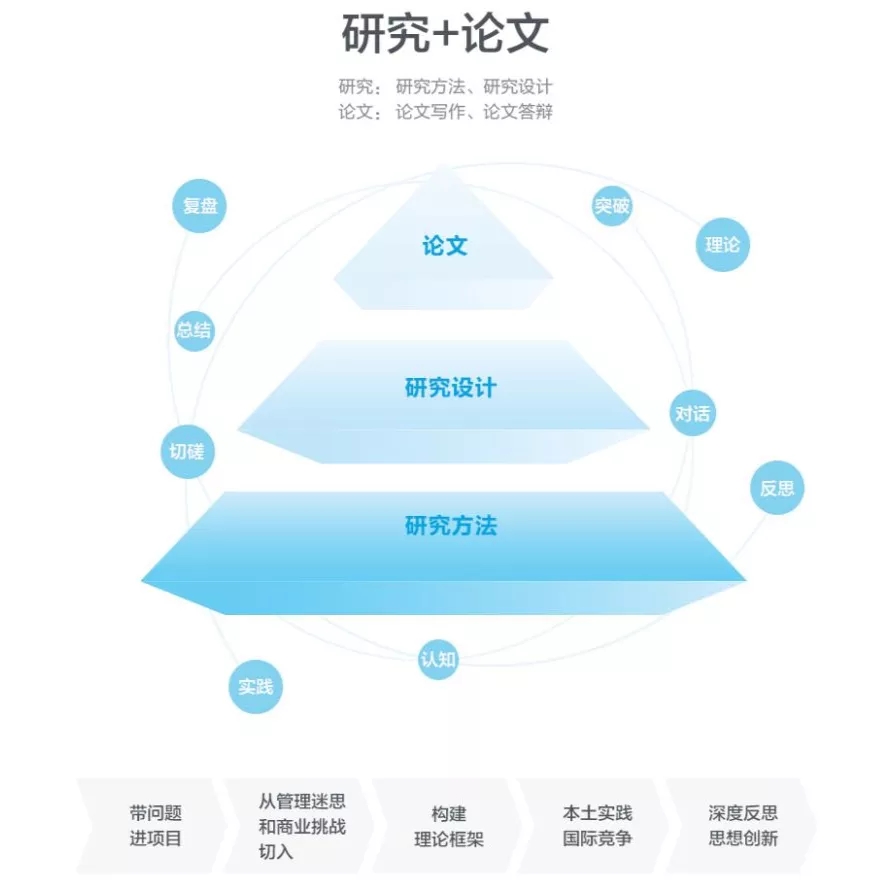

企业家学者项目(DBA)依托长江商学院专注管理教育十余年之势能,整合全球优质教育资源,打造极具前沿性和系统性课程。同时,秉持成就新商业文明思想者和引领者的愿景,深刻洞察全球经济转型与发展,深入总结行业趋势和规律,以应用型研究为导向,将学术的严谨与新鲜的实践碰撞。张建新同学在这样的学习与体验中不断提升,实现了“理解-判断-实践-引领”的跨越式发展,积极参与全球化进程,与优秀企业家共同迎接新商业文明的挑战,为中国和全球经济发展贡献“长江力量”。

本次论文答辩,来自长江商学院和新加坡管理大学(SMU)的教授们共同见证了张建新同学的学术成果。

OU-YANG Hui

Professor of Finance,CKGSB

WANG Rong

Associate Professor of Finance,SMU

TANG Qian

Assistant Professor of Information Systems,SMU

张建新 | 构建对食品产业互联网企业进行业绩预判和价值评估的第四张报表方法研究

张建新同学答辩中

▇ 论文摘要:

长期以来,产业界、金融机构、PE投资基金和资本市场投资者判定一家企业的经营业绩和市场价值,通常以该企业提供的经过审计财务三张表的数据为依据,并进一步做综合分析进行评估。由于会计准则的局限性,财务三张表不能真实反映企业经营的全部情况,同时以传统生产制造业为主体的经济阶段和以数字经济为主体的经济阶段,对于财务信息的范围、侧重和表现形式要求也有很大的区别。越来越多的上市公司在财报中大量使用没有被会计准则准确定义的数据,同时发审委、交易所也越来越多的在审核、问询中要求上市公司和拟上市公司进一步披露非财务数据。如何确保这些数据披露的规范性、一致性、可衡量性、客观性、可追溯性,已经成为比较现实的要求。

2016年,在上海国家会计学院举办的一场研讨会上,德勤中国合伙人提出和解释了企业第四张报表的理念,即通过非财务数据,以用户为核心,建立涵盖用户、产品和平台三个维度的企业价值评估体系,为企业管理层提供更深入的洞见。我们认为针对行业和业务模式两个维度的细分业态,针对性的设计和构建第四张报表,有利于清晰的梳理业务数据和财务表现之间的关联影响,从而提前对第三张报表的未来表现进行预判,提前发现企业的潜在价值提升空间,从而做出正确的投资决策。本文通过投资案例研究以及问卷调研,详细论证的构建“第四张报表”的重要性以及其在具体投资过程中实践的有效性。

答辩现场

▇ Abstract:

For a long time, industry, financial institutions, PE investment funds, and capital market investors have determined the business performance and market value of a company, usually based on the data of the three audited financial tables provided by the company, and further comprehensive analysis is carried out. evaluate. Due to the limitations of accounting standards, the three financial tables cannot truly reflect all the business conditions of the enterprise. At the same time, the economic stage with traditional manufacturing as the main body and the economic stage with the digital economy as the main body are concerned with the scope, focus, and focus of financial information. The performance requirements are also very different. More and more listed companies use data that is not accurately defined by accounting standards in their financial reports. At the same time, the issuance review committee and exchanges are also increasingly requiring listed companies and prospective listed companies to further disclose non-listed companies in their audits and inquiries. financial data. How to ensure the standardization, consistency, measurability, objectivity, and traceability of these data disclosures has become a more realistic requirement.

张建新同学在DBA课堂上

In 2016, at a seminar held by the Shanghai National Accounting Institute, Deloitte China partners put forward and explained the concept of the company’s fourth report, that is, through non-financial data, with users as the core, establishing a platform that covers users, products and platforms The three-dimensional corporate value evaluation system provides deeper insights for corporate management. We believe that the targeted design and construction of the fourth report in the two dimensions of industry and business model will help to clearly sort out the correlation between business data and financial performance, so as to make the third report in advance. Pre-judge the future performance, discover the potential value enhancement space of the company in advance, so as to make the correct investment decision. Through investment case studies and questionnaire surveys, this paper demonstrates in detail the importance of constructing the "fourth report" and its effectiveness in the specific investment process.

合影

论文答辩圆满结束,但作为终身学习者,这是张建新同学的又一个起点。未来的日子里,他将带着对中西管理学理念的认知与思考,继续践行新商业文明;用独到的洞见,不断为中国经济注入新动力,并引领行业的发展方向。